For Donors

GIVE – to Improve Life in Northwest Kansas

Become a partner in giving

Anyone can give, and many people come to a point in their lives where they feel inclined to give back. They do so for a number of reasons, all very personal to them. And you do not need to be “wealthy” to give! Whether creating a named fund, contributing to an existing fund, making a gift in memory of a friend or loved one, or making an unrestricted gift to a fund for Greater Northwest Kansas benefit, every person in the community can make a difference. There are four easy steps to giving:

1

Commit to Give

Make a conscious decision that you wish to give a financial gift to a charitable organization which most interests you and/or your family.

2

Choose What to Give

You may wish to give a one time cash gift, share in a bountiful harvest, designate a portion of a life insurance policy to a charity, include the charitable cause in estate planning, make distributions from an IRA to a charity, name a charity in a transfer on death deed, or one of many other giving options.

3

Determine How to Give

Work with your local community foundation board or GNWKCF to determine the best way to give that aligns with your personal goals: give to an existing fund or establish a new fund or scholarship.

4

Decide When to Give

Work with your accounting or legal services to determine the best time to donate to maximize your charitable giving.

Explore Giving Options

Give Now

Gifts to one of our existing funds increases the impact of local community grant making. Online giving through our website provides a secure way to use your credit card to support your community today; or you may mail a check to the community foundation c/o GNWKCF, P.O. Box 593, Bird City, KS 67731.

Create a Living Legacy

For many of us, there is a compelling need to make a difference – to leave a lasting impact on the people most dear to us and the world in which we live. The search for significance and desire to plan for the future leads many to ponder their legacy. Through the power of endowment, funds established at your local community foundation allow your family’s name and charitable aspirations to live forever – creating a stable, enduring legacy to benefit future generations as you specify.

A Chinese Proverb says:

The best time to plant a tree was 20 years ago ~ the second best time is now…

Contact us to learn how to establish YOUR LEGACY FUND.

Give to Matching Events

All of our affiliated community foundations hold at least one matching event each year. When you make a donation during that designated time frame, funds raised will be matched by another donor increasing the overall impact of the donation. Regardless of how it’s matched, your CHARITABLE DONATION will go FARTHER to benefit the organization’s mission when contributed during a MATCHING EVENT.

Like us and follow us on Facebook to get notified of a Matching Event in your community.

Give Cash Crops

Consider sharing your bounty with your local Community Foundation as a GIFT of GRAIN or any cash crop. It’s easy to do and makes a huge impact to your local foundation.

A grain donation is not actually reported on a Schedule A as a charitable deduction. By donating grain instead of giving cash or a check, the actual value from that donated grain is not added to income on the Schedule F. Instead, the donation is recognized by lowering a farmer’s taxable income, as well as lowering income subject to self-employment taxes. With income tax changes in 2018, farmers are encouraged to speak with their tax consultants on the best way to realize a true tax savings while supporting their community charitable organizations.

Contact GNWKCF if you would like more information on how to give from your farm cash crops. Download the donation form HERE.

Estate Planned Giving

If you haven’t taken the steps, the reality is that you won’t have a say in how your estate will be handled. Without the proper documents, upon your death the state of Kansas gets to decide who gets what. This automatic estate plan rarely matches your own preferences and additionally the probate process can be lengthy and very costly. You should have control over the final disposition of your property. Every adult individual or married couple needs an estate plan, regardless of how much they own. A plan gives you the opportunity to make very important decisions regarding how your assets are distributed tax efficiently, including your charitable legacy.

GNWKCF offers resources to help you start a conversation on planned giving that includes your favorite charity or community foundation

Resources for Giving

A Guide to Planned Giving

Overview of Charitable Funds

Overview of Charitable Instruments

Stewardship Counseling Service

Why Give to a Community Foundation?

A community foundation is a public charity that focuses on supporting a geographical area to address community needs and supports local nonprofits. When you donate to your local community foundation, you are supporting charitable causes close to home. Because it’s a public charity, you receive the tax advantages of making a charitable contribution.

Whether you’re a potential donor, a professional adviser, a local nonprofit director, or someone who is simply concerned about the future of northwest Kansas, connecting with the Greater Northwest Kansas Community Foundation is the first step toward a better tomorrow for northwest Kansas!

Contact us for more information

GNWKCF

103 W 4th Street

PO Box 593

Bird City, KS 67731

(785) 734-2406

Darci Schields

Executive Director

[email protected]

Gennifer Golden House

Director of Donor Services

gennifer@danehansenfoundation.org

Types of Funds

Designated Funds

Funds which support a specific charitable organization or community foundation designated in the establishing documents.

Donor Advised Funds

A charitable fund in which the donor recommends grants to charitable organizations of his / her choice. Download more information HERE.

Field of Interest Funds

A fund established to provide grants to specific causes (not just one specific charity) you designate such as the arts, education, health and human services, a geographic location, or the environment. Download more information HERE.

Organizational Funds

A fund specific to a named community foundation or charitable organization.

Scholarship Funds

A fund to disburse scholarships to students meeting a set criteria (geographic, field of study, academic performance, community service, etc.), generally on a competitive basis, to be used for educational expenses. Scholarships are made payable to the educational institution on behalf of the student and not payable directly to the student.

Download more information HERE.

Unrestricted Fund

A fund in which a broad range of interests and activities may receive grants empowering the community foundation to make strategic grants wherever the greatest need and opportunity exists.

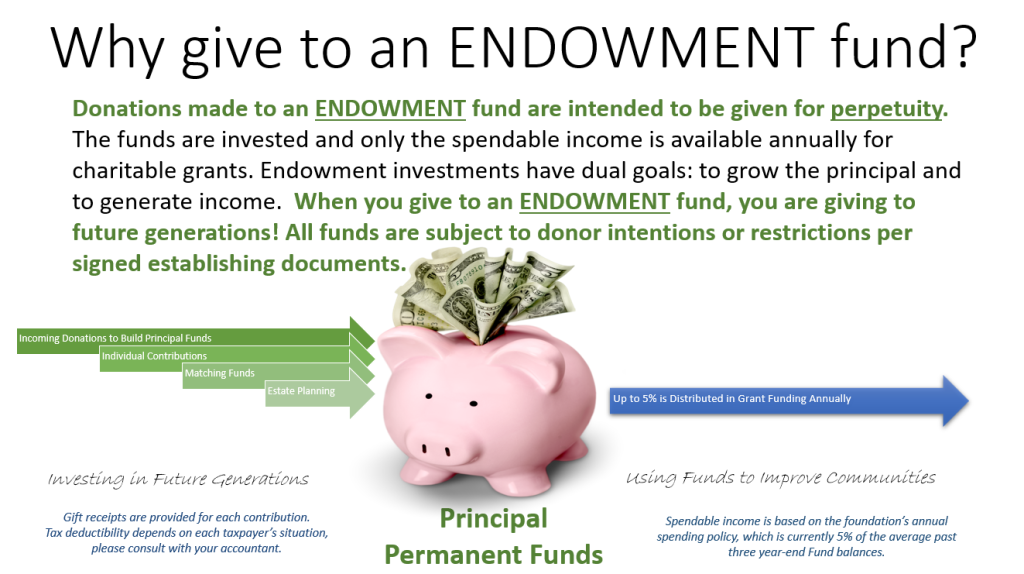

Endowed vs Non-Endowed

Donations made to an ENDOWMENT fund are intended to be given for perpetuity. The principal funds are invested and only the earnings are available for charitable grants.

Donations made to a NON-ENDOWED fund may be granted at any time per the guidelines of the established fund.

All funds are still subject to donor restrictions or intents per establishing documents.